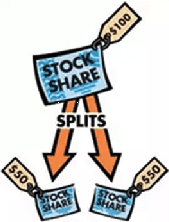

A share split is a decision made by a company’s directors to increase the number of shares that are outstanding by issuing more shares (for free) to current shareholders. For example, in a “2-for-1” share split, an additional share is given for each existing share an investor holds, resulting them in having twice as many shares as they did before. This term has been in the news recently as Tesla (5-for-1), Apple (4-for-1) and Pushpay (4-for-1) have all completed or announced them. In Apple’s case, this is the company’s fifth share split since it went public.

This type of corporate action highlights another concept that investors sometimes struggle to get their heads around – that the share price alone actually gives no indication of a company’s value. A company’s share price is just the value of the company, divided by the number of outstanding shares. For example, if a $1m company has 1 million shares, then each share will be worth $1. If that same company decides instead to issue 2 million shares, then the share price will be worth $0.50, and if they decided to only issue 500k shares, then the share price would be $2. In each of these cases, the company’s value is still $1m. This same rationale applies to share splits, i.e. if Apple has a 4-for-1 share split, we would expect the share price to fall by 75%, all else being equal. In reality, the share price can often perform well (after the split) as a cheaper share (e.g.: $250 vs $1000) may seem more affordable to smaller investors, as well as increasing the liquidity through an increase in outstanding shares able to be traded.

It’s important that investors understand this concept, as unfortunately NZ investment culture still seems to result in an aversion to “expensive” shares, such as Mainfreight ($60), Fisher and Paykel Healthcare ($34) and Ebos ($25).