Having an incorrect PIR can lead you to either overpaying, or underpaying tax. 120,000 Kiwi’s received a letter from the IRD recently flagging that the wrong tax rate had been applied to their KiwiSaver account.

This means many underpaid tax, and received bills accordingly.

Unfortunately, it also meant that some were overpaying tax. These KiwiSaver investors will not receive a refund for overpaid tax. This demonstrates the importance of having the correct tax rate recorded on any investment, but particularly, PIE investments.

A portfolio investment entity or PIE is an entity which invests the contributions from its investors in different types of passive investment. PIE’s were created in 2007 to better align incentives between different types of investing. Until that point, investors in managed funds effectively paid the top tax rate.

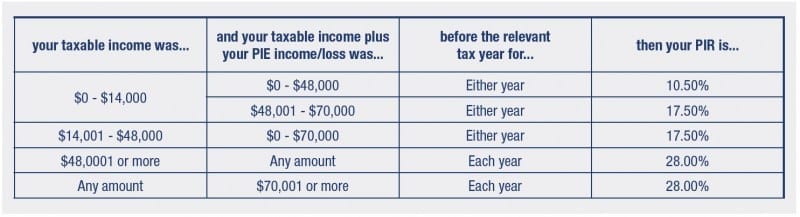

The change meant that individual investors could select their Prescribed Investor Rate based on your taxable income in the last two income years, e.g., income from salary, wages and any additional sources of income you would include in your income tax return. PIE attributed income will also be taken into account. The prescribed rates are 10.5%, 17.5% and 28%. You can calculate your PIR with the table below.

HHG managed investors should now have received their tax report for the last tax year. Please review your rate, and contact your adviser if you think if should be changed or have any questions.