Seemingly not a day goes by where various media commentators espouse their opinion on the current level of the New Zealand share market, almost uniformly describing the market as overvalued. On the face of it, this seems perfectly reasonable, given the market is hitting all-time highs on a daily basis. But do these highs really represent a market that has outperformed? Detailed analysis tends to prove otherwise.

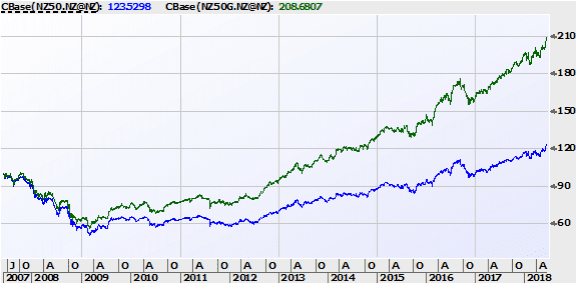

The chart above tracks the New Zealand share market since its highest point it hit before the GFC. You will notice a big discrepancy between the blue and green lines. The Blue line is the NZX Capital Index, the Green line is the NZX Gross Index. The Gross Index level is what is quoted in the media. As you can see, since May 2007, the Gross Index (Green) is up 108% but the Capital Index (Blue) is up only 23%The chart above tracks the New Zealand share market since its highest point it hit before the GFC. You will notice a big discrepancy between the blue and green lines. The Blue line is the NZX Capital Index, the Green line is the NZX Gross Index. The Gross Index level is what is quoted in the media. As you can see, since May 2007, the Gross Index (Green) is up 108% but the Capital Index (Blue) is up only 23%

So, why the difference?

It’s actually quite simple. A Capital Index reflects the share world scenario that companies are worth less after they pay their dividends. This is simply because they no longer have the cash in their bank account due to the payment. Thus when a company pays a dividend of say $0.10, all things being equal, its share price will fall $0.10. A capital index will fall to reflect this drop in the share price.

A Gross Index, in contrast, does not fall when a company pays a dividend. It reflects BOTH share price movements AND dividend payments. So even though the company in the example above is trading on the market down $0.10 because it has paid its $0.10 dividend, the Gross Index will not drop.

Why is this difference so important?

For these 3 main reasons:

- In direct contrast to the NZX, every other main world index, such as the NASDAQ or Dow Jones, whose level we are quoted against, are capital indices.

- The NZX is one of the highest, if not the highest, yielding share markets in the developed world.

- A Gross Index does not reflect the real price movements of the companies within the index.

Movements in the Gross Index level can give a false impression of share price growthMovements in the Gross Index level can give a false impression of share price growth

As mentioned above, the NZX has one of, if not the highest, income yields of any developed country share market at around 5.5%.

Thus, the return of the entire NZX market for 12 months a scenario where every single company’s share price was unchanged, the Gross Index would still be up 5.5% due to the level of the dividends that were paid. Investor’s portfolios however would show share price growth of 0%.

How does the NZX Index compare then on a “like for like” basis with overseas peers?

Since May 31 2007

Dow Jones 85%

S&P 500 82%

NASDAQ 198%

NZX50 Capital Index 23%

Conclusion

I don’t think the average investor would be overly concerned that they are overpaying for an asset that has returned just 23% capital growth over the past 11 years, or just 1.91% p.a. compounding.

While each investors share portfolio will be unique to their particular circumstances, media commentary of “record highs” should not concern or prevent investors from investing in the market.

For those looking for income, the market is very attractive and share prices, contrary to what one might intuitively think, have not performed strongly when looking over the medium to long term (which is what share investors should do).

In short, ignore the ‘fake news’ of record highs, the NZ market still represents real value, especially those looking for income.