Summerset Group Limited

Summerset Group Limited delivered record a record 1H (first half) underlying net profit (i.e. excluding valuation gains) of $75.5m, which was far ahead of most analysts’ expectations. This net profit was generated from equally impressive record new sales and resales, showing the strength of the business. Off the back of a strong housing market, we expect SUM will be able to increase their prices over the near future, more than offsetting any inflationary pressures. Analysts have been quick to upgrade their target prices, with one setting theirs at $18.90!

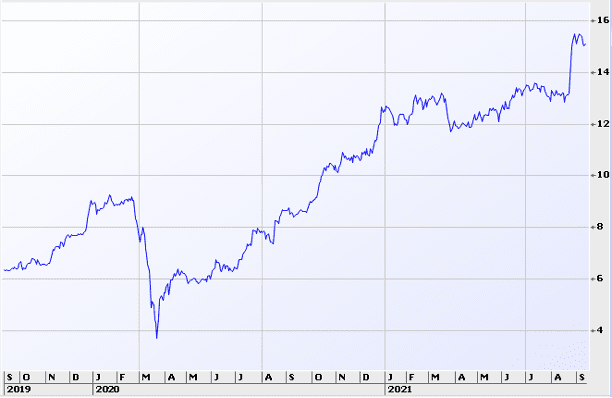

Ebos Group Limited

Hamilton Hindin Greene have been fans of this stock for a long time, so there’s a very good chance it is already in your portfolio. For those that don’t, or who feel they may be a bit underweight, this was another great result from a very impressive company. A continuation of good results has proven they are somewhat immune to the economic effects of Covid, and the diversified nature of their business has proven to be a real strength. While all segments of their business have performed well, the real standout was their “pet health”, which had an increase in EBIT (earnings before interest and tax) of a whopping 26.4%. They have guided to more growth, their intention to look for more acquisitions, and increased their dividend pay-out ratio. Given this mixture of income and growth, Ebos remains one of our top picks for most portfolios.

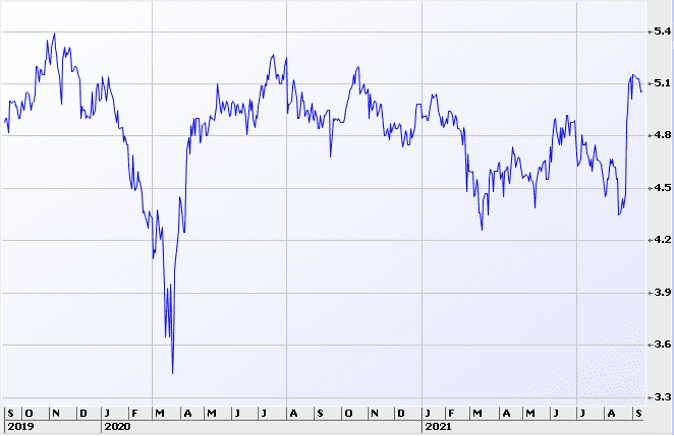

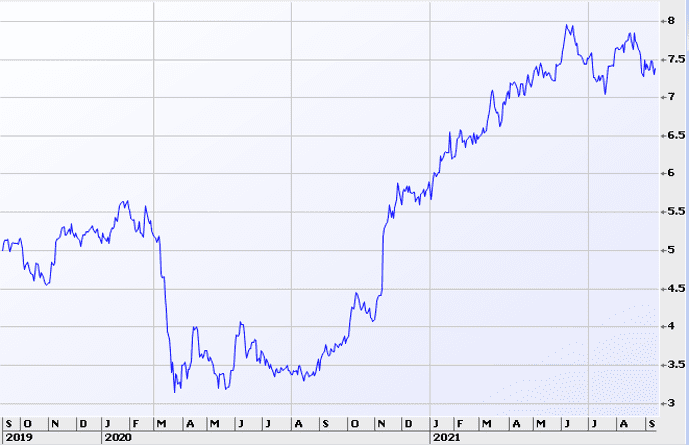

Heartland Group Holdings Limited

A solid result from Heartland, who beat their net profit guidance ($87m vs. guidance of $85-$86m) and raised their next year’s net profit guidance to $93-$96m. Based on this, they have an expected gross (pre-tax) dividend yield of 7.7%, which makes them very attractive to income investors. For those that want to avoid investing in the Aussie banks, Heartland provides a nice alternative option in the sector.

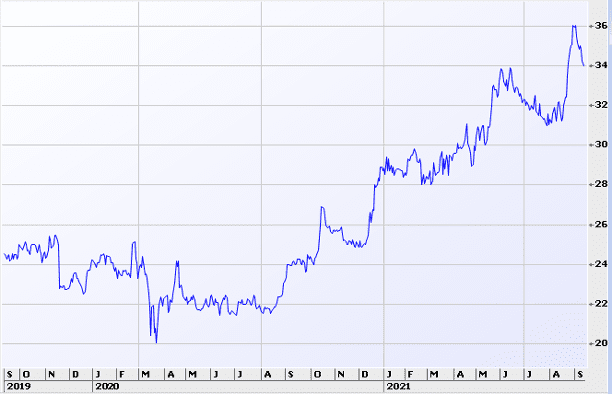

Fletcher Building Limited

A great turnaround for what has been one of NZ’s more disappointing companies over recent history. They posted a net profit of $305m (compared to a covid impacted loss of $196m last year), declared a final dividend of $0.18, and is expected to continue its impressive performance by being the beneficiary of a strong NZ economy (Covid allowing) and strong residential housing demand. An ongoing share buyback should also provide some support to the share price.

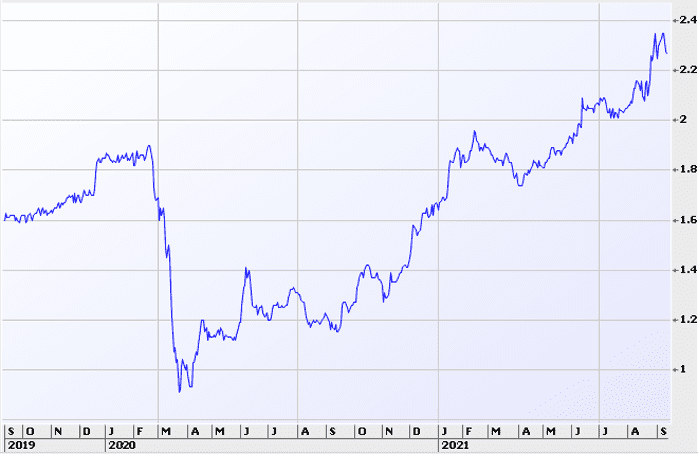

Scales Corporation Limited

Scales Corporation’s (SCL) first half results are very good, and have resulted in them lifting their full year net profit guidance quite substantially. Scales have been able to achieve higher pricing after their shift to apple types that fetch more of a premium, which has more than counteracted any increase in wage/logistic costs. They are deemed an essential service, so can continue to operate under level four conditions, and were lucky to have completed the harvest before this latest outbreak. We again saw the benefits of a diversified business, as the petfood manufacturing side (Food Ingredients) reported sales 30% higher than last year.