NZ Banks have huge exposure to the housing market, with $320 bn of residential lending. It therefore makes a lot of sense to listen to what they are saying regarding the housing market at present.

Currently all five of New Zealand’s major banks expect house prices to drop in 2022.

In November, the BNZ noted that “there are far too many people saying the Reserve Bank can’t raise interest rates much because it would result in weak growth, an increase in the unemployment rate and, potentially, a significant fall in house prices. The Reserve Bank won’t say it so explicitly, but this is the very point of increasing rates.”

ANZ expects the Reserve Bank to raise the official cash rate rapidly over the next year, something that is already being reflected in their mortgage rates, which have risen from lows of around 2%p.a. for 1 year fixed, to 3.65% (depending on your LVR). The 2 and 3 year rates are now above 4% at all major banks. A doubling of interest costs surely changes the math in terms of the attractiveness of borrowing to invest.

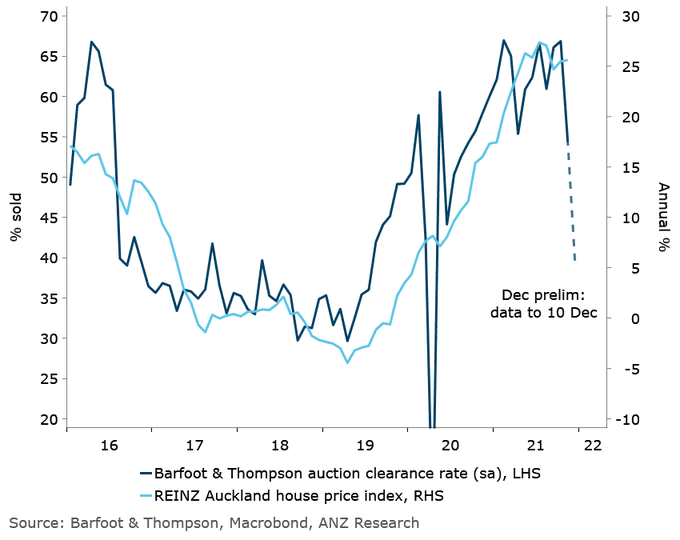

This is starting to show in leading indicators. ANZ recently released this table which shows a significant drop in the clearing rate at Barfoot & Thompson auctions. As you can see from the table, this rate tracks quite closely top the REINZ Auckland House Price Index. Momentum can be a big driver in investment decisions, and whilst many rushed in due to fear of missing out, it is not impossible to see a similar rush to the exits.