There are lots of different rules and guidelines bandied around when it comes to investing. I have spent much of my career trying to avoid catching falling knives or buying on rumour and selling on news – you may have your own personal favourite. But one of the earliest ones I was taught was “Sell in May and go away”.

What is less well known is the second part of that rhyme. The full quotation dates back a couple of hundred years to London’s Financial district when the Bankers, Merchants, and Aristocrats would sell their positions in May, escape the heat of the London summer, and return in September. The full phrase being “Sell in May and go away, come back on St Legers Day” and there is some merit in it considering the summer months are usually a little quieter – no Christmas or New Year celebrations, and bonuses were traditionally paid at the beginning or end of the year so there was less money sloshing around in the middle of the year.

What is so special about St Legers Day? Whilst St Leger was a Catholic Saint, I think the city types of the day were more interested in the St Legers flat race at the Doncaster Racecourse in the UK. First run in 1776 it is the oldest of the classic horseraces in Britain. And this year was scheduled for the 11th September 2022 with the favourite “New London” coming in second.

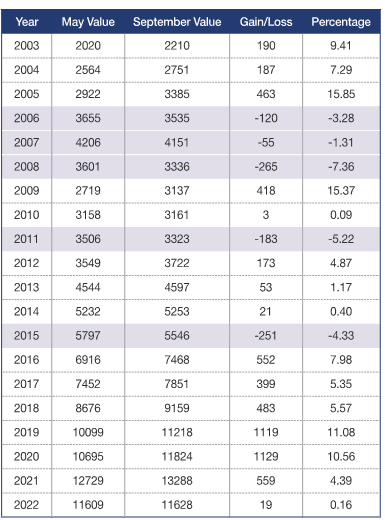

So, there’s the history but does the rule actually work? Most importantly does our centuries old rhyme from the London markets have any relevance to the New Zealand markets of today? I had a look at the NZ50 values in May and September over the last 20 years.

It would seem that selling in May and coming back in September would only have been a benefit in five of the last 20 years. Whilst this strategy worked best in 2008 by avoiding much of the fallout of the global financial crisis, the same strategy the year after would have missed a 15% gain. However, buying in September would have seen a rise in the value of the NZ market six months later in 15 of the last 20 years.

Selling in May is no longer relevant to today’s markets. But the last 20 years illustrates that the NZX50 had risen from 2020 points in May of 2003 to 11628 points at the beginning of September 2022. If nothing else, it shows a “buy and hold” strategy works and timing the market is more difficult than spending time in the market.