Whilst predicting short term share market returns is difficult at the best of times. The longer-term trend is easier to read.

What we do know is the power of compounding interest. Albert Einstein reportedly said “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”.

Investors in the share market have benefitted greatly from compounding interest over the years.

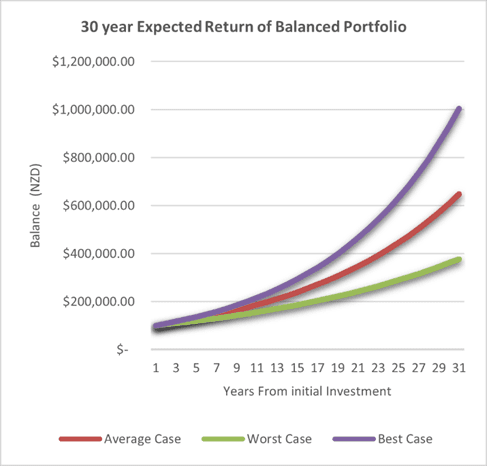

The table shows how compounding works for $100,000 invested in a model balanced portfolio. Obviously, there is a degree of variance in results, however, we can see that the returns have compounded over time. The average case result over 30 years saw the $100,000 grow to over $600,000.

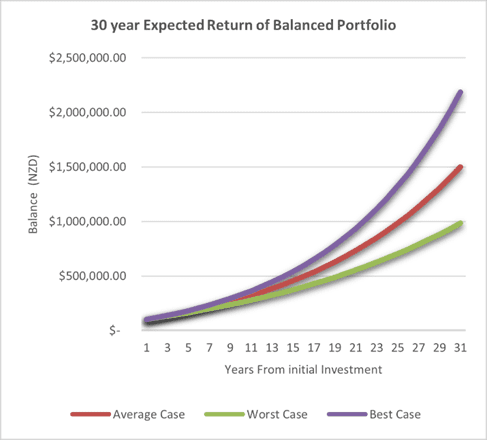

However, regular deposits can supercharge these results. If you are able to add $10,000 per annum to your portfolio, keeping your initial investment of $100,000 unchanged, then the average case result over a 30-year period sees the portfolio grow to $1.5m.

If you are in a position to contribute regularly to your portfolio, let your adviser know. It’s much more beneficial to invest every quarter (for example) than save up and invest the whole lot at the end of the year.

Your adviser may not suggest investing spare funds immediately, but opportunities are constantly popping up for a variety of reasons (a good company result or a share becoming particularly good value etc.), so let your adviser know if you have cash available for investment and they will contact you at the appropriate time.

*These analytics are based on long term assumptions and the normal distribution curve. Losses and gains may occur more often or fall outside the specified ranges more regularly than normal distribution model would imply. The figures above are gross, and have not been adjusted to account for tax, brokerage, inflation or management fees.