Human beings are inherently reactive, a trait embedded in our DNA from our early ancestors. Picture an early human navigating the dense jungle. Every rustle or snap could signal danger – another tribe or a lurking predator. The humans who responded to these sounds lived to see another day, while those who ignored them often fell prey.

Fast forward to the present day, and this instinct to react still influences our behaviour, particularly when it comes to investing. The stock market is a jungle of its own, filled with noises that investors often feel compelled to react to.

A prime example of this was the initial stages of the Covid-19 pandemic. The market plummeted by 30% in just over a month, causing panic among investors. Some sold their shares, while others shifted from a growth asset allocation to a more conservative one in their KiwiSaver accounts. Unfortunately, these reactive investors missed out on the subsequent recovery, which saw the market close out 2020 at record highs.

While the pandemic is a recent and notable example, there have been countless events throughout history that could be described as the metaphorical lurking predator.

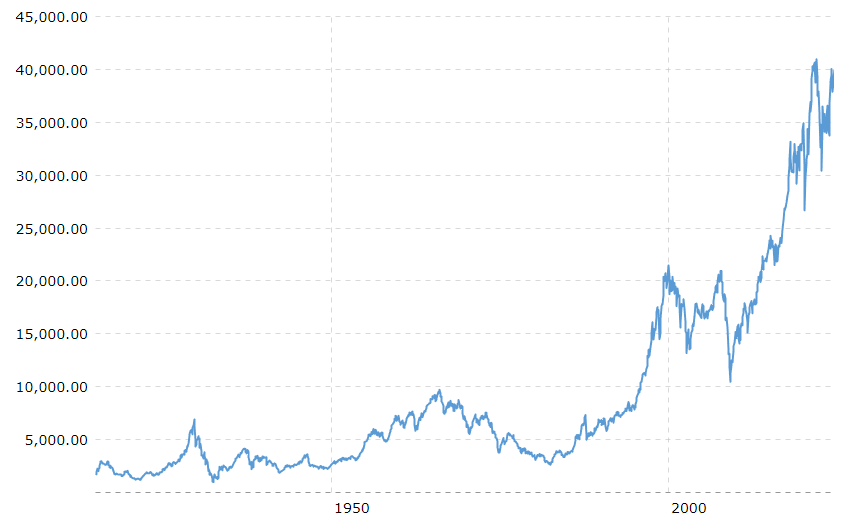

However, historical data suggests that in the realm of investing, it’s often better to resist this urge. Consider the performance of the Dow Jones since January 1915. Despite numerous historical events that caused short-term market fluctuations, the index has grown from 55 points to over 40000 points. From a long-term investment perspective, these events are mere blips on the radar.

Investors who maintained their course during these periods of uncertainty, continuing to buy, fared even better than those who merely held on. This illustrates the power of patience and long-term thinking in investing.

So, the next time the market roars, just remember – you’re not in the jungle anymore. Keep a steady hand and think long-term. History shows it’s usually the best move.