FINANCIAL PERFORMANCE:

- Revenue: EBOS reported a significant revenue increase of 7.8%, reaching $13.2 AUD billion for the fiscal year 2024, marking the first time the company has surpassed the $13 billion mark. This growth was driven by strong performance in both the Healthcare and Animal Care segments.

- Underlying EBITDA: The company recorded an underlying EBITDA of $624.3 million, up 7.3%, demonstrating consistent earnings growth across its business segments.

- Net Profit After Tax (NPAT): Underlying NPAT reached $303.4 million, representing a 7.7% increase, and earnings per share (EPS) grew by 6.8% to 157.9 cents.

- Dividends: The final dividend ended at NZ 61.5 cents per share, bringing the total dividends for the year to NZ 118.5 cents per share, up 7.7% from the previous year. This reflects a payout ratio of 69.5%.

SEGMENT PERFORMANCE:

- Healthcare Segment: The Healthcare segment, which constitutes the majority of EBOS’ revenue, grew by 8.0% to $12.6 billion, with underlying EBITDA increasing by 6.0% to $548.0 million. This segment benefited from strong market positions, particularly in Australia, where revenue and EBITDA grew by 8.0% and 9.4%, respectively.

- Animal Care Segment: The Animal Care segment saw revenue growth of 3.2% to $579.0 million, with underlying EBITDA increasing by 13.2% to $112.2 million. This growth was primarily driven by higher-margin businesses and the successful acquisition of Superior Pet Food Co.

STRATEGIC INVESTMENTS AND ACQUISITIONS:

- EBOS made several strategic acquisitions, including increasing its shareholding in Transmedic, a leading medical devices distributor in Southeast Asia, to 90%. The company also completed the acquisition of Superior Pet Food Co. and four smaller bolt-on acquisitions in the Medical Technology and Medical Consumables businesses across Australia, New Zealand, and Southeast Asia.

- These investments align with EBOS’ strategy of diversifying and growing its core businesses, especially in Healthcare and Animal Care, further solidifying its market position and expanding its geographical reach.

FINANCIAL METRICS:

- Return on Capital Employed (ROCE): ROCE increased by 20 basis points to 15.3%, aligning with the company’s target.

- Net Debt to EBITDA Ratio: EBOS reduced its Net Debt to EBITDA ratio to 1.89x, compared to 2.06x in December 2023, reflecting improved financial leverage.

OUTLOOK FOR FY25:

- EBOS provided positive guidance for FY25, expecting underlying EBITDA to range between $575 million and $600 million. This reflects a growth rate of 5% to 10% in the underlying business, excluding the impact of the non-renewal of the Chemist Warehouse Australia (CWA) contract, which contributed approximately $2.2 billion in revenue for FY24 but ceased on 30 June 2024.

- The company plans to focus on base business growth, community pharmacy revenue expansion, cost reduction initiatives, and continued strategic acquisitions to drive future earnings.

SUSTAINABILITY AND ESG INITIATIVES:

- EBOS continued to advance its Environmental, Social, and Governance (ESG) strategies, including the electrification of its facilities with renewable energy sources, sustainable packaging initiatives, and partnerships with environmental and social organizations.

- The company is committed to reducing its environmental footprint, with a target to generate clean energy equivalent to its forecasted Australian electricity needs by FY27.

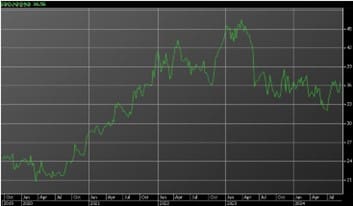

SHARE PRICE PERFORMANCE:

- EBOS’ share price stood at $36.56, reflecting a slight increase of 2.99% year to date. Over the past five years the EBOS is up 53% plus dividends.

Conclusion: The announcement from EBOS is largely positive, showcasing strong financial performance, strategic growth through acquisitions, and continued investment in its core segments. Despite the anticipated impact of the CWA contract’s cessation, the company has set a solid foundation for continued growth, underpinned by its diversified business model and expansion plans.

5 year chart of EBOS