RISING RATES AND RISING INFLATION

The shift in global interest rates expectations since late last year has been one of the most dramatic in modern history.

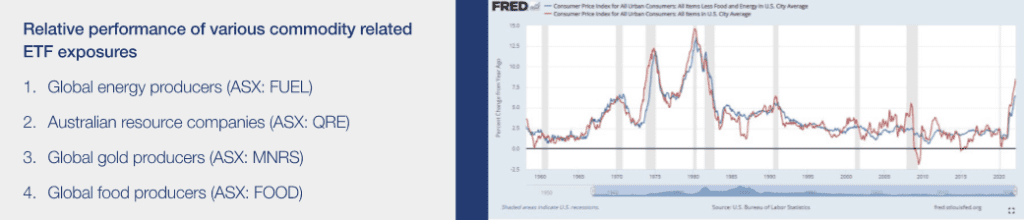

A major catalyst for the shift in interest rate expectations has been the persistent rise in inflation, especially in the U.S. As evident in the chart below, both headline and core U.S. consumer price inflation have lifted to the highest rates in 40 years. Russia’s invasion of Ukraine has only added to upward food and energy price pressures, given that both these countries are major food and energy exporters, and their supplies threaten to be severely disrupted if hostilities rage on for several more months.

COMMODITY EXPOSURES IN A PERIOD OF RISING INFLATION

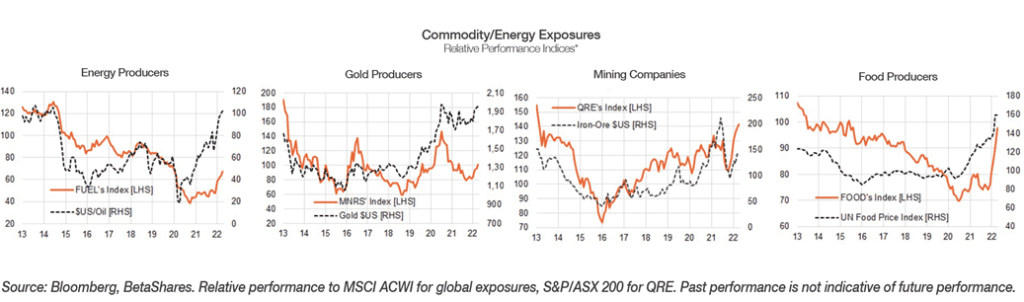

When Russia first invaded Ukraine, some of the investment exposures of most potential interest in this heightened inflationary environment are in the commodities areas.

All have enjoyed solid performance versus global equities over the past month, in line with the strength in oil, gold, food and iron-ore prices. As is also apparent, commodity exposures in general have been outperforming since late last year – before Russia’s assault on Ukraine – in line with the solid post-COVID recovery in global economic growth.

GLOBAL BANKS – SLOW GRIND HIGHER AS RATES RISE

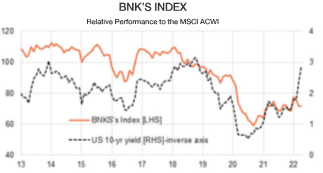

The fifth exposure which has tended to do relatively well in an environment of rising interest rates is the BetaShares Global Banks ETF (ASX: BNKS). This is because rising rates tend to be associated with stronger profits margins as medium-term bank lending rates tend to widen by more than the cost of short-term funding costs. Rising credit demand due to strong economic growth also tends to be supportive of global banks.

As seen in the chart above, global banks have tended to outperform since late 2020 – in line with the trend higher in bond yields. They suffered a modest relative performance setback more recently despite the further surge higher in bond yields.

This appears to reflect concerns over the possible financial market impact of global sanctions on Russia, such as the write-down of certain Russian financial assets and even a potential sovereign debt default. That said, given the substantial lift in global interest rates – and the likelihood they may well rise higher or at least hold around current levels – there appears to be scope for further potential “catch-up” relative performance by global banks in coming months.