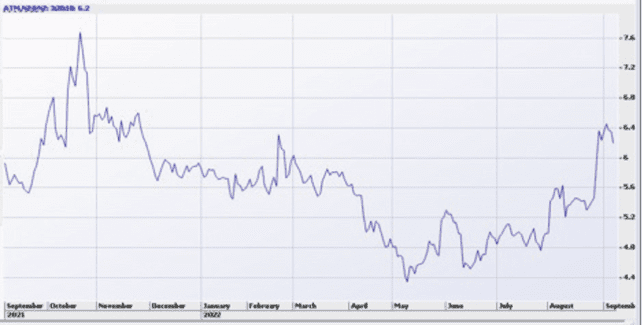

Morningstar maintains it’s NZD 8.00 (Currently $6.24) fair value estimate for shares in a2 Milk following the release of fiscal 2022 earnings.

Underlying EBITDA of NZD 196 million was a 59% lift on the previous corresponding period, or PCP, and 14% higher than our prior forecast.

Despite increasing pricing pressure from foreign and domestic competitors, a2 continues to gain share in the ultra-premium Chinese label business.

While we adjust our near-term forecasts, we remain optimistic for a2’s growth potential in Chinese infant formula, and our longer-term forecasts remain broadly intact. We think guidance of “high-single-digit” top-line growth in fiscal 2023 is conservative, given market share gains and strengthening brand health in the second half, and we forecast revenue growing 12% in fiscal 2023 to NZD 1.6 billion. But we lower our fiscal 2023 EBITDA forecast by 14% to NZD 253 million as the company flagged a further uptick in marketing spend. We are not concerned by the increased cost guidance. We had already expected a permanent step-up in distribution and marketing costs as the company shifts focus to growing the Chinese-label business without the same support from reseller channels.

We expect an increased marketing focus to further bolster unprompted awareness, which has upside compared with peers. A sharpened focus on brand building is increasingly crucial now the favourable tailwinds for foreign brands have abated. We think a2 has carved out a competitiive advantage beyond merely New Zealand—a2’s narrow economic moat is underpinned by significant brand assets in China, as evidenced by its increasing share in Chinese-label infant formula and top-tier retail pricing.

Risks:

There are material risks facing the company in regard to Chinese regulatory approval. The company is confident in receiving another license in February as they have done in the past. Geopolitical tensions between NZ and China are also a key risk. The company’s balance sheet is healthy with no debt and $816.5 million in cash. They have announced a $150m share buyback which implies they feel they have excess cash on hand. This will be supportive for the share price.

Suitability:

This stock is suited for growth orientated investors who can hold the stock for at least two to three years.

Investment thesis:

A2 Milk is a premium infant formula and milk producer that suffered materially with the border closers and freight issues associated with the pandemic. As the pandemic moves forward, these issues are expected to be resolved. A2 milk notified the market of significant progress of addressing these issues with revenue up 19.8% and profit up 51.8% yesterday. The shares rallied 10% on the news. A2 Milk is the 13th largest business on the NZX50 with a market capitalisation of $4.45bn NZD.