Key Developments

There remains a degree of uncertainty over New Zealand’s growth. A weaker-than-expected earning reporting season dragged the New Zealand share market lower over the month of February. The New Zealand share market profit reporting season for the December period got off to a weak start with pre-result season profit downgrades from Air New Zealand, Fletcher Building and Ryman. Reporting season got better with the core of New Zealand companies delivering on expectations. Overall, the New Zealand share market has seen more profit misses against expectations by number than beats and more post-result consensus earnings forecast reductions than increases. Net earnings downgrades generally reflected costs continuing to increase while revenue slowed. But there were signs of a basing in earnings with several companies noting green shoots of a recovery in activity and a peaking in the rate of cost increases.

RBNZ rate hikes remain off the table, at least that was the message we and the market took from the February MPS. The central bank left the OCR at 5.50%, lowered its OCR forecast path by 10bp to peak at 5.6% and implied rate cuts to start in H1 2025, from H2 2025 previously. This was unexpected by most of the bank economist community who had ascribed some chance to a hike, two even calling for a hike, and not anticipating the OCR forecast path would be lowered. The market was also conscious of the hawkish risk, which led to a notable market reaction. Short-term interest rates fell c.20bp and the NZD depreciated c.1% following the decision. The tone was much more balanced than the November MPS and the speech from Chief Economist, Paul Conway, in late January. The RBNZ recognised that excess capacity was becoming evident, and this was partly related to tight monetary policy working. Core inflation and most inflation expectation measures have declined, such that inflation risks have become more balanced. The RBNZ did note, however, that with inflation still above target, tolerance for upside surprises is low. We continue to expect rate cuts to begin in August, at which point it will be abundantly clear that an OCR 300bp above neutral is not necessary.

The US economy remains in good health, suggesting Fed rate cuts aren’t imminent. Real-time estimates of GDP growth are in a 2-3% range and the labour market continues to create jobs. US CPI inflation surprised on the upside in January. Minutes from the US Federal Reserve’s January meeting noted the recent strength in the economy and that the Committee is carefully assessing the need for policy adjustment. The minutes also reiterated the message from the January statement that the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. Markets currently price 80-90bp of cuts this year, vs. 150bp at the beginning of the year and the median Fed ‘dot plot’ forecast of 75bp.

The rest of the world doesn’t look so good. Euro area growth remains non-existent with the manufacturing sector contraction offsetting expansion in the services sector. With core inflation falling, the European Central Bank is likely to start easing before the middle of this year. China continues to struggle. Lunar New Year spending data showed weaker per capita spending and a domestic tourist preference for cheaper destinations. Consumer and producer prices are falling, the real estate sector hasn’t yet stabilised, private investment is in decline and consumption is weak. In Australia, recent data have shown a larger-than-expected softening in activity, job growth and inflation. RBA Governor Bullock recently indicated that she thought the tightening cycle was likely finished. The market currently prices 40-50bp of easing this year, taking the cash rate below 4% by year end.

Market Outlook

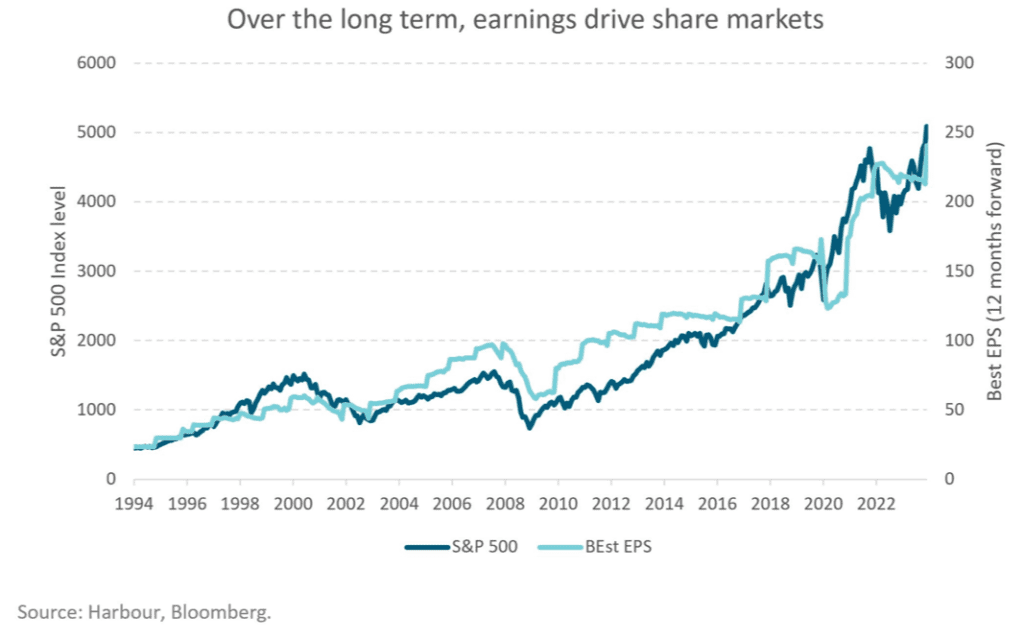

Share markets may be in a transition period in terms of economic settings and company earnings trends. While the recent earnings reporting season was mixed, we may be on the cusp of a better earnings environment. The prospect of less volatile interest rate conditions provides better valuation support than has been the case over the last 12 months. Transition periods have favoured selective investment and active equity portfolio management, with an increasing dispersion in returns between shares in companies that are better positioned for change from those that are not.

The recent rally in parts of the global share market has driven the proportion of market capitalisation in shares with high valuation multiples to levels similar to those reached during the highs of 2021. In contrast with 2021, the weighted average cost of capital (WACC) is much higher today and investors are focused on margins rather than ‘growth at any cost.’ While share markets may see a pull-back from recent highs, we continue to expect markets to make further gains through the year. Official interest rate cuts later this year (by the US Federal Reserve, and possibly from the RBNZ and Reserve Bank of Australia) should support share market valuations. Falling rates and rising earnings per share can be an explosive combination for share market returns.

For the last several months we have held the view that monetary policy is tight and that this will slow the economy and bring inflation down. We believe we are seeing more tangible evidence that this is happening, and it clearly sat behind the RBNZ’s more balanced appraisal of inflation risks going forward. While we have held our core view, market rates have been volatile, with the 2-year swap rate peaking at 5.8% in October, before falling to 4.6% in December, rising to 5.3% in February and in early March it now sits just above 5.0%. Prevailing market yields suggest there is still considerable scope for further sizable falls in time. Market pricing, at the time of writing, anticipates the Official Cash Rate only declining to 3.9% by the end of 2026. That is three more years of tight monetary policy and well above the 2.5% long-run neutral cash rate estimate at the RBNZ. It is worth considering that if inflation does settle near 2% and the economy remains very soft, one could argue for easy policy settings, with an OCR below 2%.