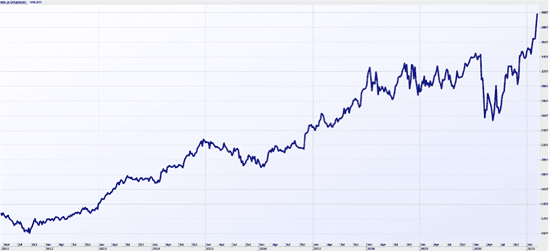

BRK10-year Price Chart

Berkshire Hathaway is a holding company with a wide array of subsidiaries engaged in diverse activities.

The company is the well-known investment vehicle run by Warren Buffett and Charlie Munger. Their record over the last 40 years speaks for itself. They look for businesses that they can understand, in stable industries, with able and trustworthy management, consistent earnings, a sensible price tag and a long-term competitive advantage.

The firm’s core business segment is insurance, run primarily through Geico, Berkshire Hathaway Reinsurance Group and Berkshire Hathaway Primary Group. Berkshire has used the excess cash thrown off from these and its other operations over the years to acquire Burlington Northern Santa Fe (railroad), Berkshire Hathaway Energy (utilities and energy distributors), and the firms that make up its manufacturing, service, and retailing operations (which include five of Berkshire’s largest non-insurance pre-tax earnings generators: Precision Castparts, Lubrizol, Clayton Homes, Marmon and IMC/ISCAR).

Berkshire also have large holdings in Apple (owning 5.4% of Apple shares),

Bank of America (12%), American Express (18.8%), Coca-Cola Co (9.3%, and Kraft Heinz Co (26.6%).

Berkshire closed out the December quarter with a large cash pile ($138.3billion USD). This gives the company a war chest, that could be committed to investments or acquisitions should attractive opportunities arise (this makes the company a good defensive play should we see a down-turn in markets).

The large cash position, and the requirement to hold cash for the insurance business means Berkshire Hathaway would benefit from any rise in

interest rates.