Many investors have been taking advantage of the relatively high Term Deposit rates. In fact, according to the Reserve Bank of New Zealand, household Term Deposit investments have risen from $92b in September 2021, to sit at $147b today (the big-4 banks send their thanks).

This is understandable given term deposit rates were at 15-year highs. However, if you have a Term Deposit coming due soon, we believe you should discuss your options with your adviser before locking rates in for another 6 or 12 month term.

This is because rates are forecast to be cut aggressively over the next 18 months. The ANZ is currently forecasting an Official Cash Rate of 3.50% in December 2025 (currently it is 5.50%). In practice that means that Term Deposit rates this time next year will be materially lower than where they are now, perhaps closer to 4%p.a. than 5%p.a.

What your adviser recommends will come down to your personal situation, however a few options include longer dated fixed interest. There are some options on the secondary market, however an upcoming new issue may also be of interest. Details are a little thin on the ground, but BNZ have announced that they have plans to make an offer of Perpetual Preference Share to the market. The rate for this would likely be in the 6.5-7%p.a. range for 6 years. If this interests you, then please let your adviser know and they can explain the intricacies of the offer.

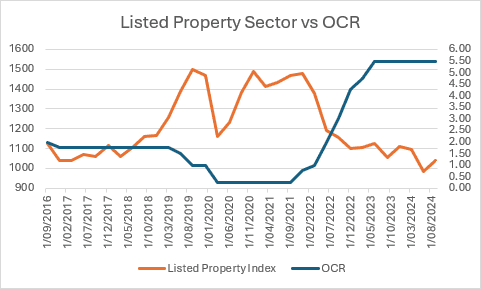

Whilst we are on the subject of interest rates, we should check in on the listed property sector. This area of the market has had a very difficult few years, dropping 30% from highs reached in 2021.

You can see in the chart below that the listed property sector (orange) started to rally in 2019 as interest rates were cut. With the exception of the Covid selloff the sector remained elevated as interest rates were near zero, and was sold off aggressively as interest rates went up. They’ve rallied off recent lows on the prospect of lower rates. Given the reasonably attractive dividend yields in parts of the sector, there could be opportunities for investors looking to maintain the income they’ve enjoyed from Term Deposits recently. Once again, investors should talk to their adviser about their options.