Income Opportunity – New Zealand Property Stocks

As interest rates continue their rise and noble fight against inflation, property stocks have fallen on average 21% from their highs in September of last year. As share prices fall, their dividend yield has increased and on many fundamental factors are appearing to look attractive.

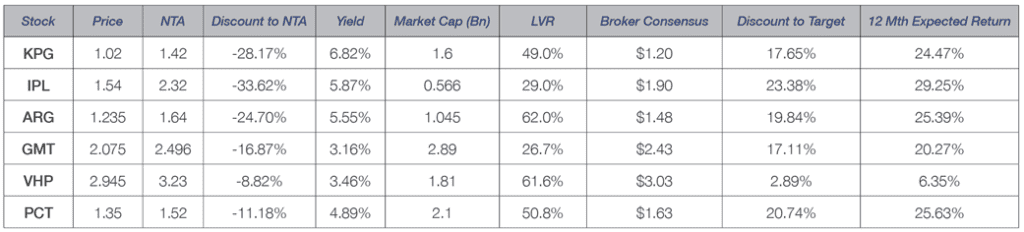

The table above shows an analysis of the property commercial companies list on the NZX. All of which are trading below their net tangible assets (NTA). NTA is a measure of what the underlying value of the buildings are worth, less their debt.

Commercial property contracts often have a ‘ratchet’ clause when their lease is renewed to adjust the rent upward inline with inflation. As annual inflation is currently running at 6.9%, the companies will be able to lift their rents which will help to increase the value of the buildings and the money available for dividends.

Key risks include a higher than expected official cash rate (OCR), currently predicted to hit 3.90%. The working from home trend means lower demand for office buildings. Companies with exposure to Wellington may have expensive remediation to bring their buildings up to code. On that last point, most of these property companies tend to stay away from ‘C’ grade buildings which require the most remediation.

Property makes a core component of any portfolio. With the reduction in prices recently it may pay to see if you are underweight property. Talk with your adviser to see which of these companies would be suitable for you.