February was a disappointing month overall for New Zealand investors. The NZX50 index was down 1.1% for the month, whilst the S&P500 was up 5.17%, and the ASX200 was broadly flat.

This continues a recent trend of the NZX50 underperforming its global peers.

I’ve discussed the reasons for this under- performance in previous Chairperson updates, so won’t rehash this in detail, but in short, our inflation rate has not dropped as quickly, which means our interest rates may be slower to drop.

NZ’s GDP growth has also been lower than global peers (relying heavily on immigration).

The NZX also has limited exposure to technology stocks, an area that has led global markets in the last 12 months.

Whilst these challenges are causing our market to underperform at the moment, I believe the NZ market will have its time again. There are many quality companies, that will recover in time as our economic picture improves, and/or we begin to see interest rates reduce.

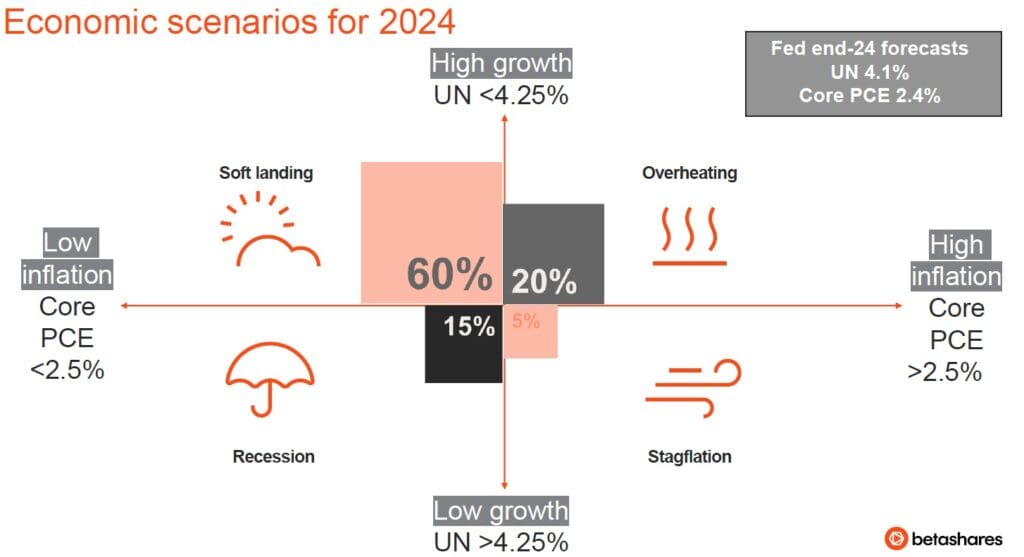

At our Investment Committee meeting in early March, we heard from Betashares Chief Economist David Bassanese. He shared with us many reasons to feel more confident. This includes an ever-increasing chance of a soft landing in the US.

A soft landing had looked very unlikely a few years ago as inflation took off, causing many economists to forecast that we would need a recession to bring inflation under control. This would have seen higher unemployment and lower growth. At this stage, it looks like inflation may come down in the US without too much economic pain.

While the decision to maintain the status quo was widely anticipated, the somewhat dovish tone of their statement came as a surprise.

Leading up to the meeting, the focus in the markets was on how hawkish the Reserve Banks stance could be. There were concerns that they might issue a strongly worded statement indicating the need for further tightening. These concerns originated from the Reserve Banks November statement, where they expressed dissatisfaction with the pace of inflation decline and signalled a low tolerance for any delays in returning to the target.

The monetary policy statement highlighted three key points:

- Inflation risks are more balanced compared to November’s concerns about slow inflation decline.

- Monetary policy remains restrictive, impacting demand and the economy.

- Both domestic and global growth (ex-US) are weak.

Economic data supports these themes. Retail spending has declined over eight quarters, the labour market is weakening, and the government is cutting spending. Building activity and housing market indicators also show signs of slowdown.

This was reflected in the more recent reporting season. To circle back to the beginning of this article, the NZX50 was down 1.1% in February. There were a number of companies that disappointed the market with downgrades, or weaker than expected results.

Some of these will be familiar names. The sectors include retail, construction, agriculture, tourism, recruitment, and aged care (covered in detail overleaf).

Whilst these updates are clearly not a good thing for investors, what they do indicate is that the Reserve Bank’s restrictive policy is having the desired impact.

Investors with a glass half full approach can take solace in the fact that this further reduces the chance of any future rate rises from here, as the purpose of the rate rises to this point look like they may have been achieved (curtail economic activity and therefore inflation).

The old adage that it is always darkest before the dawn may apply here.

We’ve seen over the last few years that the New Zealand market is very susceptible to interest rate movements. It is looking increasingly likely that the next interest rate movement in New Zealand will be downwards. This bodes well for the NZ market.

Grant Davies – Chairperson