The boring, and simple Trump Trade is the Vanguard Russell 2000 ETF (VTWO). If the S&P500 tracks the largest 500 companies in the US, the Russell 2000 tracks the 1001 to 3000 largest. They’re not small companies by NZ standards, most would make it into the NZX50, however they could be a beneficiary of Trump 2.0 (could because who knows what policies will make it from the campaign to become law).

Why Consider the Russell 2000?

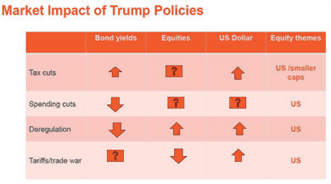

- Potential Tax Cuts: Small-cap companies, paying higher effective tax rates, could see a greater earnings boost if corporate tax rates are reduced again.

- Historical Outperformance: Following the 2017 Trump tax cuts, the Russell 2000 outperformed the S&P 500, showcasing its sensitivity to favourable tax changes.

- Domestic Focus: With less exposure to global trade disruptions, small caps could benefit from U.S.-centric economic growth and protective policies like tariffs.

- Diversification Opportunity: Provides exposure to domestically oriented sectors such as consumer discretionary, financials, and industrials, which align with U.S. economic strength.

The Russell 2000, which tracks small-cap U.S. companies, presents a compelling opportunity, particularly if corporate tax rates are lowered again in the US. Small-cap companies tend to pay higher effective tax rates compared to large-cap corporations, which often leverage international tax strategies to reduce their obligations. A reduction in corporate tax rates would likely have an outsized impact on small caps, boosting their net earnings and enhancing their growth potential relative to globally diversified large caps.

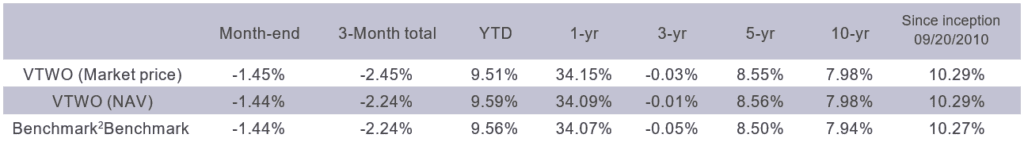

While the Russell 2000 has underperformed the S&P 500 in recent years—returning approximately 8.5% annually over the last five years compared to the S&P 500’s 15% annualized returns—it is worth noting that small caps outperformed for a period following the 2017 corporate tax cuts under the Trump previous administration. After the Tax Cuts and Jobs Act (TCJA) reduced the corporate tax rate from 35% to 21%, small caps experienced a substantial earnings boost due to their higher pre-cut effective tax rates and domestic focus.

Additionally, small-cap companies are well-positioned to benefit from U.S. trade policies, such as tariffs, that protect domestic industries. Many firms in the Russell 2000 rely on domestic supply chains and cater to U.S. consumers, insulating them from international trade disruptions while potentially gaining a competitive edge against foreign competitors. This dynamic, combined with the potential for future tax cuts, underscores the growth opportunities within the small-cap segment. For investors seeking to capitalize on U.S.- centric economic growth, the Russell 2000 offers an attractive option with the potential for renewed outperformance.

Insights

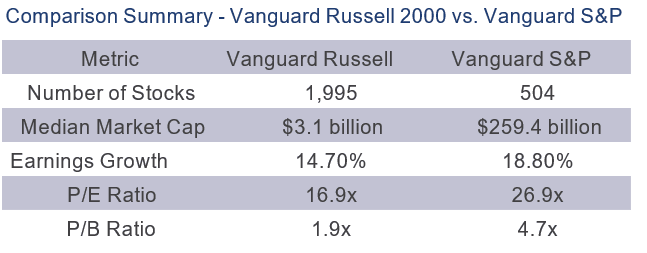

- Number of Stocks: The Russell 2000 has a much larger number of stocks, indicating a broader exposure to smaller companies.

- Market Capitalization: The median market cap of the S&P 500 is significantly higher, reflecting its focus on larger, more established companies.

- Earnings Growth Rate: The S&P 500 has a marginally higher earnings growth rate, which might suggest better growth prospects among its constituents.

- Valuation Ratios: The P/E and P/B ratios indicate that the Russell 2000 is relatively cheaper compared to the S&P 500, which could appeal to value investors.

Other comparisons to consider:

- Market Conditions: The Russell 2000 often performs better in a declining interest rate environment, while the S&P 500 may be more resilient during economic downturns due to its larger, established companies.

- Sector Concentration: The S&P 500 has a heavy concentration in Technology (over 25%) and Healthcare (around 15%), while the Russell 2000 features a more balanced distribution across sectors, with significant exposure to Industrials and Healthcare.

- Recent Performance: In the past 5 years, the S&P500 has out-performed considerably, up almost 90% vs. the Russell 2000 being up approximately 45%.