The disparity in KiwiSaver balances between women and men has recently come under the spotlight over the last month after the latest research conducted by Te Ara Ahunga Ora The Retirement Commission released in February 2024.

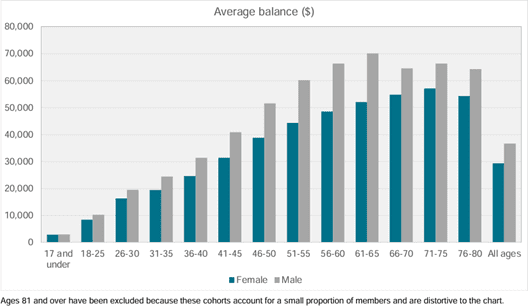

As of 31st December 2023, there were 3,274,618 members in KiwiSaver and of those, 51.2% being female, yet the average balance of Women’s KiwiSaver is $29,291, whereas the average male is $36,605 being 25% higher on average.

This disparity arises from several factors, including career breaks for raising children, going into part-time work and lower wages.

Statistics show that women’s participation in the workforce and their earning potential are crucial for their retirement savings. For example, women who take time off for caregiving miss years of KiwiSaver contributions and employer matching, which can significantly impact their retirement savings. On average, a woman who takes a five-year career break can end up with a KiwiSaver balance that is 20% lower than that of a continuous contributor.

In Australia, the Government is taking steps to address the gap by paying superannuation contributions to women on paid parental leave, this law will take into effect as 1st of July 2025. There have been no announcements to date of New Zealand following a similar suit.

Another issue is the gender pay gap where women in New Zealand earn about 8.6% less than men on average. Pay discrepancy limits a women’s capacity to contribute as much to their retirement savings again. Thankfully, the government announced in August last year that a mandatory gender pay reporting system will be introduced, requiring organisations with over 250 employees to report their gender pay gaps, then to be introduced to those with over 100 employees. This aims to enhance pay transparency and compliments the Government’s efforts in amendments to the Equal Pay Act in 2020. While this is only an announcement, I was unable to source when this was to take into effect.

Source: MJW KiwiSaver Demographic Study – February 2024

What actions can we take?

While I have stated the obvious that women are at a disadvantage. Relying on structural and behavioural factors to change the gender savings gap will require employers and policymakers to make legislative changes. Closing the gap for better equality could be years away. Those years of waiting could cost you, literally thousands.

The Ministry for Women has emphasised the importance of financial literacy and proactive engagement in retirement planning for women. Financial education can help women understand their investment options and make more informed decisions about their KiwiSaver contributions and fund choices which could address these challenges.

Initial steps, take action on your own KiwiSaver nest egg! Easier said than done, but let’s normalise not being afraid by reaching out to your existing provider or an investment adviser to talk through your KiwiSaver options. By taking proactive steps now, women can significantly improve their financial security and retirement readiness.

Unsure of what to ask? Before reaching out, make sure you know who your provider is and what fund your KiwiSaver is invested into. Some might not know both of those answers, to easily find this you can contact IRD where they can disclose this to you.

Once you have this in hand, perhaps think about the following before making that call.

- What is your end goal? Are you looking to use this for your first house deposit or for your retirement?

- What is your understanding of KiwiSaver?

If you are still feeling unsure, then talking to an investment adviser can provide you with the clarity and direction you need to confidently move forward.

I believe in empowering women in seeking financial advice when it comes to KiwiSaver is essential. There can be significant life changes that can impact our ability of making the right contributions based on your retirement savings goal and preference to risk if advice isn’t taken up. One example is being made aware of the minimum contribution of $1,042.86 into your KiwiSaver each year to receive the government contribution of $521.43. A 50% bonus that you will not receive with any other investment scheme in New Zealand.

It is the little pieces of knowledge like this that can give women the understanding of their options and can bridge the savings gap to ensure better financial outcomes in retirement that could potentially be achieved.

Sarah Brennan – HHG Investment Adviser