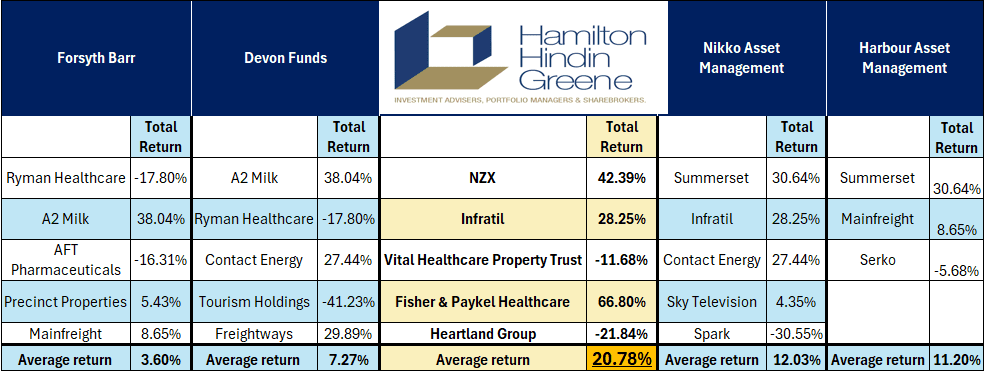

As we wrap up 2024, we’re excited to share that Hamilton Hindin Greene’s stock picks have outperformed our peers, securing the top spot in the National Business Review’s (NBR) annual stock picks review. This achievement highlights our commitment to providing insightful and profitable investment advice to our clients.

NBR’s Stock Picks Overview

Each year, the NBR invites leading New Zealand investment firms to share their top five stock picks for the upcoming year. Hamilton Hindin Greene has been an active participant in this, consistently delivering strong recommendations based on thorough market analysis and strategic foresight.

Performance of Our 2024 Stock Picks

So how did we do? Well, our 2024 stock picks have shown impressive performance, reflecting our strategic investment approach:

*Harbour Asset Management only provided three listed companies.

Going into 2024, Hamilton Hindin Greene selected a diverse portfolio of stocks, focusing on sectors with strong growth potential and resilience. Here were our top five picks and the rationale behind each choice we made:

- NZX Ltd (NZX): As the operator of New Zealand’s stock exchange, NZX Ltd is poised to benefit from increased market activity driven by a positive economic outlook and interest rate cuts. Additionally, NZX’s funds management business, Smart, manages over $12 billion in assets, offering diversified exposure to global and local markets. In 2024, NZX returned a total of 42.39%, driven by increased market activity and strong performance in their funds management business.

- Infratil (IFT): Infratil’s diverse portfolio includes investments in digital infrastructure, renewable energy, healthcare, and airports. Their focus on data centres is responding to the surge in demand for data capacity, positioning them well to capitalize on the increasing need for secure, large-scale data centres. Their return of 28.25% is no surprises there.

- Vital Healthcare Property Trust (VHP): Unfortunately, this pick experienced a negative return of -11.68%, driven by unrealised property revaluation losses and rising borrowing costs due to increased interest rates. The trust’s debt ratio increased to 39.1%, amplifying the impact of adverse market conditions. Additionally, the S&P/NZX All Real Estate Index experienced a decline of -8.3%. These factors, combined with sector-wide pressures, contributed to underperformance compared to the broader market.

- Fisher & Paykel Healthcare (FPH): Recorded a total return of 66.80%, capitalizing on the growing healthcare sector.

- Heartland Group (HGH): Unfortunately, this pick experienced negative returns of -21.84% in 2024 due to operational challenges in key sectors like Motor Finance and Australian Livestock Finance, coupled with higher funding costs, also weighed on performance. Additionally, legacy lending issues further affected profitability during the year.

Looking Ahead to 2025

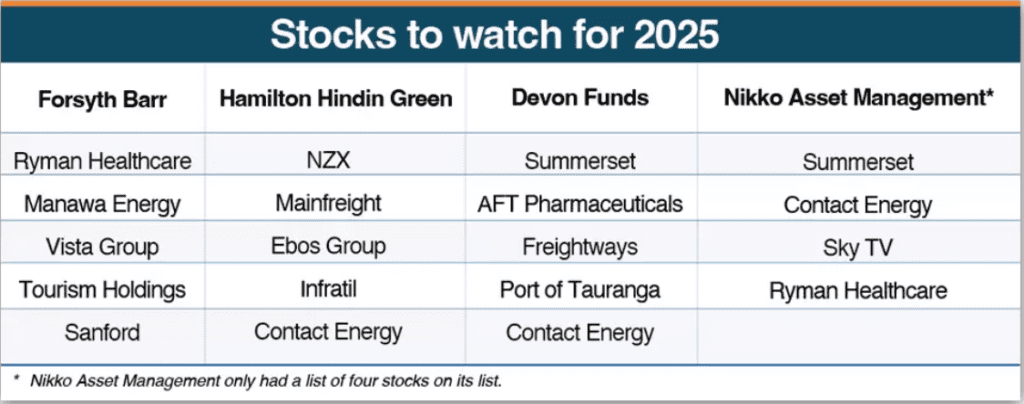

As we look forward to 2025, Hamilton Hindin Greene is once again participating in the NBR’s stock picks. Here’s a glimpse of our outlook and top picks for the coming year against our peers:

Sourced: https://www.nbr.co.nz/investment/hot-stocks-to-watch-in-2025/

NZX 50 Performance and Outlook: Hamilton Hindin Greene’s View

The NZX 50 has had a solid year, with the index rising by approximately 11% year to date. This performance has been driven by increasing business and consumer confidence, easing inflationary pressures, and interest rate cuts by the Reserve Bank of New Zealand. Looking ahead, the outlook remains positive, with further interest rate cuts expected to unlock more capital for equity markets. However, investors should remain cautious of potential global economic uncertainties and geopolitical risks.

Our Key Investment Themes for 2025

Several key investment themes are likely to shape 2025:

- Artificial Intelligence (AI): Continued advancements in AI are expected to drive innovation and efficiency across various sectors.

- Decarbonisation: The push towards sustainable energy and reducing carbon footprints will remain a significant focus.

- Longevity and Healthcare: Advances in healthcare, particularly in treatments for chronic diseases and aging populations, will create new investment opportunities.

- Geopolitical Risks: Ongoing geopolitical tensions, particularly involving major economies, will influence market dynamics.

Conclusion

We are proud of our performance in 2024 and look forward to continuing our success in 2025. If you have any questions or would like to discuss your investment strategy, please don’t hesitate to reach out to your Investment Adviser on 0800 10 40 50. We’re here to help you navigate the ever changing market landscape and achieve your financial goals.

As we sign off for the year in 2024, we would like to extend our heartfelt thanks to our clients for their continued support and trust in Hamilton Hindin Greene.