ASB Capital was incorporated in 2002 as a special purpose company to issue perpetual preference shares (ASBPA). It was a subsidiary of CBA Funding (NZ) Ltd. The ultimate parent of this company, and of ASB Bank Ltd, is Commonwealth Bank of Australia.

ASB Capital No.2 was incorporated in 2004 as a special purpose company to issue perpetual preference shares (ASBPB). In March 2006 it announced that, as part of a restructuring, the party responsible for its shares would become ASB Group Ltd. ASB Group Ltd also was to be renamed ASB Holdings.

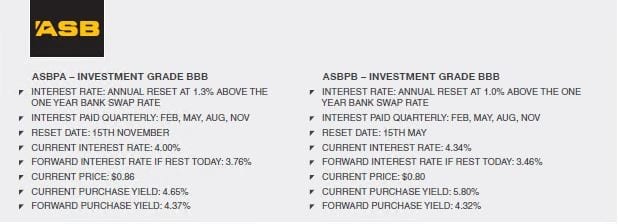

ASB has two types of equity securities listed:

ASBPA Perpetual Preference Shares – $200,000,000 ($1 Face Value) ASBPB No. 2 Perpetual Preference Shares – $350,000,000 ($1 Face Value) Total – $550,000,000

Both Preference shares are Investment PIEs with the maximum tax rate being 28%. This makes them even more attractive to investors on 30% or 33% tax rates.

However we believe there is a strong incentive for ASB to redeem the preference shares at par on or after January 2018. This is because under banking rules brought in subsequent to the GFC, the preference shares are losing their ‘Equity” status for ASB at 20% a year.

At the time of this note (March 2016) they only have 40% equity status left. On 1st January 2018 they will have 0% equity status left. Then they will effectively become debt to ASB costing 1% and 1.3% above the 1 year bank rate.

Considering ASB can issue 1 year debt at only 0.5% above the benchmark, there would be a 0.5% – 0.8% saving for ASB by redeeming the shares. This is done at par (i.e. $1).

If this was to happen, buyers of the ASBPBs would make $0.20 on $0.80 buy price + 4.6% running yield.

Buyers of the ASBPA’s would get $0.14 on the $0.86 buy price + 4.5% running yield

The key aspect of all of this is the slow transition from the equity side of the balance sheet to the debt side. This means they are transitions from a relatively cheap form of equity to a relatively expensive form of debt. This gives ASB an incentive to call the notes, which would be done at par.

What makes this investment even more attractive is the relative low risk. Essentially you would need ASB Bank (and presumably CBA in Australia) to go broke or lose money. As it is, with 60% of the preference shares already not counting as equity, they rank ahead of other preference shares equity, and issues of new hybrid securities that must turn into equity when the banks equity ratios drop too low.

To reiterate, the preference shares would only be affected if ASB Bank went broke, a somewhat unlikely scenario. Should ASB not redeem the shares in 2018, transitioning investors will own a one year reset security, that effectively ranks ahead of $5.4 Billion in equity and being a reset security protects holders from rising interest rates. Finally the shares are easily traded on the secondary market which will provide good liquidity. We are hopeful that even if the shares are not redeemed, the market will price them higher, simply on their reduced risk rating.