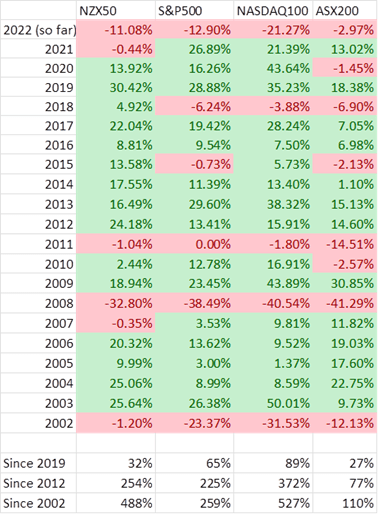

Unfortunately what started as a bad year for global markets has only gotten worse. Since January 1, the NZX50 is down -11.08%, the S&P500 is down -12.9%, NASDAQ100 down -21.27% and the ASX200 down a comparatively tidy -2.97%. These numbers reflect which companies have been most affected, with the technology/growth heavy NASDAQ index (filled with companies like Microsoft, Google, Amazon etc.) doing much worse than the resource heavy Australian ASX200 index (filled with miners, commodity producers and banks).

So why are markets falling?

Essentially there are 3 main factors at play; the Russian invasion, Covid, and inflation/interest rates. I’ll explain each in a bit more detail below.

- Russian Invasion; This is probably the easiest one for most people to understand, and affects the share market in both a quantitative and qualitative way. The quantitative way is that it has sent commodity prices, everything from oil and gas to wheat and fertilizer, through the roof. This pushes up prices for pretty much everything, which is obviously a challenge for most companies.The qualitative way is that markets don’t like uncertainty, and in Russia/Putin we are all dealing with a lot of it. Historical data shows that localised wars/conflicts don’t have much of an impact on share markets over the medium term (in fact, most result in gains), however they always have a negative effect in the short term.

- Covid; Yes, even after two and a bit years, Covid remains a big factor to business and supply chains. China’s zero tolerance policy has resulted in renewed and extended lockdowns Shanghai, which is home to the world’s largest port. This worsens the supply chain issues, leading to companies having stocking issues, or having to pay much higher freight costs. Businesses are also struggling with workers, as lots of sick days coincides with record low unemployment.

- Inflation and rates; This is the big one, and probably the hardest one to understand (although it’s the same reason your house has probably dropped in value). When Covid really hit at the beginning of 2020, central banks around the world responded by slashing interest rates to record lows, in an effort to stimulate the economy and help cushion the blow they expected would come (economists had forecast 10% house price falls, and surging unemployment). They also pumped cash into their respective economies, through both direct payments (wage subsidy etc.) and by quantitative easing (or “printing money”). At the end of 2020, most people would have agreed that they had done a good job; unemployment had stayed low, the housing market hadn’t crashed and while some parts of the economy had only survived (hospitality/tourism etc.), others had thrived (technology, building etc.). Of course, this was all somewhat too good to be true. After all, could we really expect all the borrowing, time off work and hit to productivity to not come at a cost? In reality, all governments and central banks were doing was delaying the economic pain, hoping to smooth it over rather than have it hit all at once. The cost to all that borrowing and stimulation of the economy that helped us get through the worst of Covid is the massive inflation we are all seeing today. Unfortunately the only way to reduce inflation is to reduce demand, which means central banks are rising interest rates, and quickly. Without boring you with too much detail, higher interest rates are bad for assets (shares, houses, art collections etc.), especially for growth assets, as future earnings are no longer worth as much today.

Has anything been spared?

Few and far between. Unless it’s an oil company, miner or, to a lesser extent, bank, then chances are it’s down for the year. Usually we would expect bonds to provide some safe haven to market wobbles (i.e. people sell “risk on” assets like shares and put their money into “risk off” bonds), however as interest rates going up is one of the main reasons for the markets decline, bonds have been hurt too. Gold has stayed steady and new alternative investments like crypto have had their “inflation hedge” claims well and truly questioned, with bitcoin down 24% this year.

When will it end?

While all three of the above factors are likely to last for a while, it’s important to realise the share market is always looking at what will happen, not at what is happening. An old saying is that “share markets don’t recover when they see light at the end of the tunnel, they recover when the tunnel gets a little less dark”, which essentially means we don’t need to wait for the war to end, Covid to disappear or rates to stop rising, we just need to wait until things stop looking like they’re getting worse. While no one is sure when things will turn, one thing we can be almost certain of is that when they do, they will do so very quickly.

What should we do?

For the vast majority of investors, the correct answer is to simply (although simple does not mean “easy”, or “comfortable”) hold on and ride it out, making sure you are invested for when markets bounce. As long as you are invested in good companies, then they will continue to make money and grow over the medium term. For income investors, your companies will continue to pay dividends and bonds continue to pay interest regardless of what is happening with the share price. For the more growth orientated investor, we are worried about what share prices do over a 5+ year time frame, not 1 or 2. The only times to be worried about share prices are if you need to sell (which is why investment horizons are so important) or if the drop is caused by company specific reasons. If the whole market is dropping then we just ride it out, or if possible, invest more to buy shares at a “discount”. If you have more funds available to invest for the long term then please get in touch – waiting for what feels like the “right time” will almost always mean missing out.

I thought I’d end with a visual aid, to show that while bad years can feel quite unsettling when you’re in the middle of them, over a longer time frame you can see how they are greatly overcompensated by the good years. For example, while the NASDAQ is down 27% this year, it is up 89% since the start of 2019, +372% since 2012 and a whopping +527% since 2002. To put this in $ terms; $100k invested in 2002 would be worth $627,000 now (having been through the dotcom bubble, 2008 GFC, the covid crash, today’s issues and all the other issues that were a big deal at the time). It’s worth noting the below returns don’t include all the dividends paid, so the returns would actually be even higher.