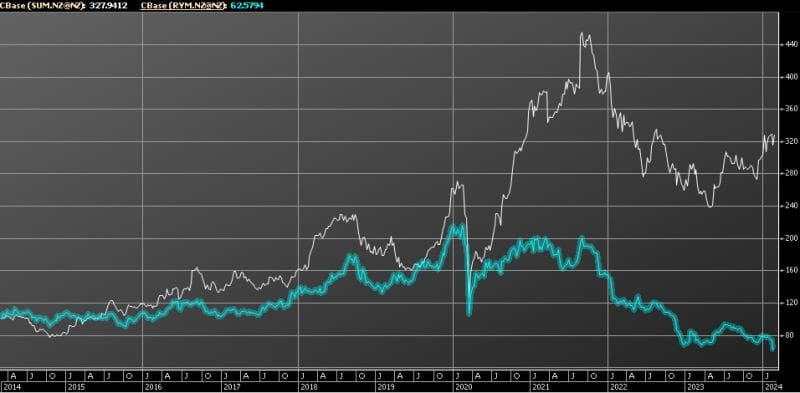

Summerset often gets compared with Ryman Healthcare. They both operate and develop retirement villages here and in Australia. However, their share prices have been anything but similar over the past 10 years.

Every $1,000 invested into Summerset in 2014 is now worth $3,270. For Ryman, every $1,000 is now worth $620 (excluding dividends).

Key takeaways from Summerset’s result:

- Record underlying profit of $190.3m, up 11% from $171.4m in FY22.

- Net profit after tax (NZ IFRS) of $436.3m, up 62% from $269.1m in FY22.

- Record realised development margin of $121.2m, up 16% on FY22 and realised resale gain of $88.1m, up 26% on FY22.

- Total assets now total $6.9b, up 19% on FY22, total equity of $2.6b and sector leading net tangible assets per share of $11.10.

CEO Scott Scoullar expressed his satisfaction with the company’s performance despite facing challenges like inflation, recruitment shortages, and a declining property market. Looking forward to 2024, Summerset anticipates delivering 675-725 homes, including the development of their first multi-level village in Auckland.

Key takeaways from the Ryman profit guidance update:

Ryman lowers profit guidance, blaming weaker sales.

- Ryman Healthcare downgrades full-year profit expectations due to lower-than-forecast sales.

- Previous profit guidance was $300 million to $330 million based on 273 ORA sales.

- Revised expectation is $265 million to $285 million with anticipated sales of approximately 218 ORAs.

CEO Richard Umbers expresses disappointment, citing an unusual weighting towards four main buildings nearing completion. Sales are expected to be deferred into the next financial year due to market conditions and building completion timing.

- Portfolio remains in a solid position with resale stock consistent with previous periods.

- Company maintains focus on cost efficiency and operating efficiencies in challenging environment.

- Expected portfolio growth of retirement village units and aged care beds to be at the lower end of the guidance range.

- Net debt on March 31 expected to be similar to levels in September 2023.

- Ryman’s share price closed at $4.52 on Friday, down 19.43% compared to a year ago.