Key Takeaways:

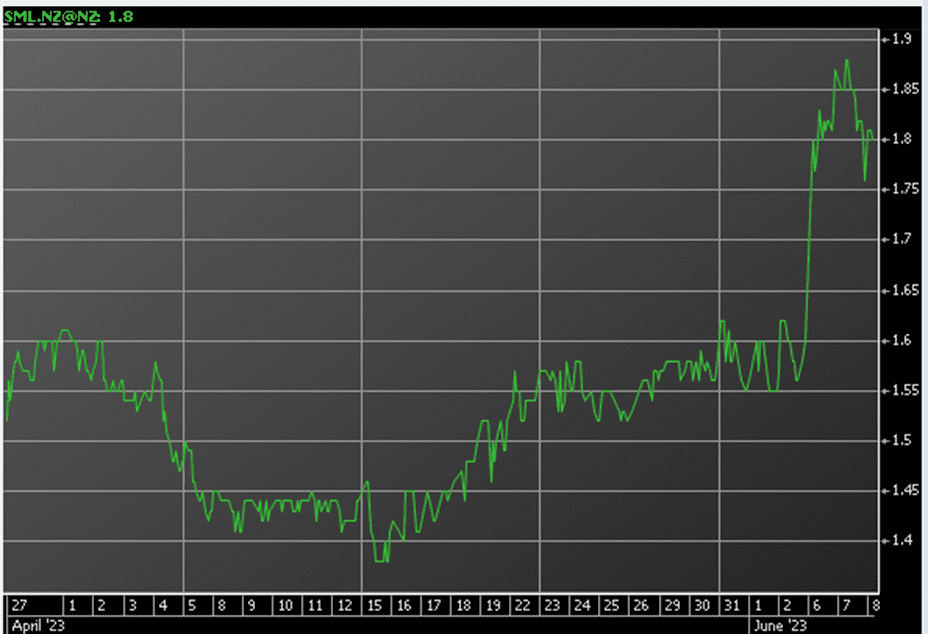

- Synlait Milk’s shares surged nearly 16% after receiving re-registration approval to manufacture A2 Milk infant formula for China. The news brought reassurance and revenue certainty, as stated by dairy consultant Stuart Davison.

- Synlait Milk’s shares closed at $1.80, a 12.5% increase, and reached a high of $1.85 during the session. A2 Milk’s shares also rose by 8.5% to $6.23 in response to the announcement.

- The yield on Synlait’s 2024 bonds, valued at $180 million, dropped from 15.69% to 11.8% following the re-registration news.

- Grant Watson, Synlait’s CEO, emphasized the significance of the license renewal as a crucial milestone. The company can now produce the registered A2 Milk product at its Dunsandel factory until September 2027.

- While the market reaction indicated that the news was not fully priced in, concerns were raised about the declining prices of imported infant formula in China. However, investment adviser Peter McIntyre viewed the license renewal as a positive development for both Synlait and A2 Milk, providing greater earnings certainty for Synlait’s banking syndicate.

- Synlait faces pressure to reduce debt amid mounting losses, with its share price dropping to $1.38. The company revised its full-year forecast, projecting a loss of $5 million to a profit of $5 million, and continues active engagement with its supportive banking syndicate.

- As part of its strategy and capital structure refresh, Synlait intends to sell its Dairyworks and Talbot Forest Cheese businesses to reduce debt.

Extended Summary

Following the news that Synlait Milk can continue manufacturing A2 Milk infant formula for China, Synlait Milk shares experienced a significant surge of nearly 16%, while bond yields eased. The announcement provided reassurance and certainty regarding future revenue, according to Stuart Davison, a global dairy consultant at HighGround Dairy.

Synlait Milk’s shares closed at $1.80, reflecting a 12.5% increase, reaching a session high of $1.85. A2 Milk’s shares also benefited from the news, rising by 8.5% to $6.23.

Furthermore, Synlait’s 2024 bonds, valued at $180 million and with a face value of $1.00, experienced a drop in yield from 15.69% to 11.8% following the announcement.

Grant Watson, Synlait’s CEO, highlighted the significance of the license renewal, labeling it as a crucial milestone. The company will be able to produce the registered A2 Milk product at its Dunsandel factory until September 2027.

Davison noted that the market reaction indicated that the news was not fully priced in, suggesting that recent leadership changes within Synlait may have affected confidence in the company’s ability to deliver. However, he cautioned that the market may not be factoring in the declining prices of imported infant formula in China, which are aligning more closely with local values.

Peter McIntyre, an investment adviser at Craigs Investment Partners, emphasized that the license renewal was undoubtedly positive for both Synlait and A2 Milk. He added that it would provide Synlait’s banking syndicate with greater certainty regarding earnings recovery in the fiscal year 2024.

Synlait has faced pressure to reduce debt amid mounting losses, with its share price dropping to as low as $1.38. In late April, the company revised its forecasts, projecting a full-year result ranging from a loss of $5 million to a profit of $5 million, a significant decrease from the initial estimate of $15 million to $25 million in profit. Synlait continues to engage actively with its banking syndicate, which remains highly supportive, and amendments to certain banking covenants for the remainder of fiscal year 2023 were approved.

As part of its strategy and capital structure refresh, Synlait announced its intention to sell its Dairyworks and Talbot Forest Cheese businesses. The proceeds from the potential divestment would be used to reduce debt.