The UK Listed trusts’ manage diversified international share portfolios and rely on the managers ability to navigate the global financial markets. These investments are listed on the London Stock Exchange and are denominated in Sterling.

Bankers Investment Trust PLC provides a one-stop shop for global equity exposure. Its legacy was strongly UK-centric exposure, while current managers have opted to invest over 60% of the fund outside of the UK. There is a strong income commitment, which has been fulfilled for more than 49 years. The fund represents an ideal core building block within portfolios.

Process: The Managers’ investment approach is focused upon valuation and the prospects for dividends is crucial, given the objective for dividend growth in excess of thr Retail Price Index (RPI). The manager outsources offshore stock selection to Henderson International and oversees the blend of styles and regions.

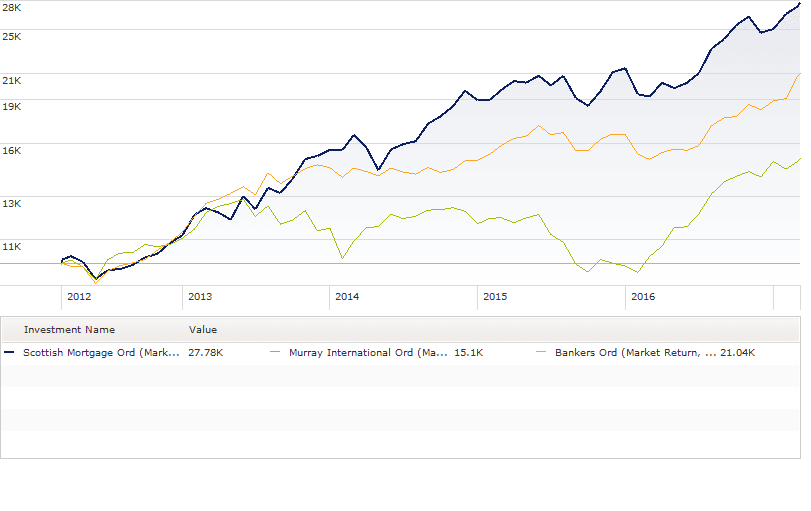

Performance: Since the manager’s appointment in July 2003, returns have been relatively strong with the fund comfortably outperforming its category peers.

Murray International Trust PLC provides both long-term capital and income growth from a portfolio that is predominantly skewed towards global equities and, in particular, Asia and emerging markets. The focus on income is an important consideration here, and the fund does provide a high and regular level of income for investors.

Process: The process is a patient, value-based approach seeking to identity quality companies at attractive valuations. Bottom-up security selection with a yield bias results in a portfolio likely to be significantly different from that of the benchmark.

Performance: The fund has delivered very strong returns over the long term. Returns over the past three years have been very disappointing for investors. More-recent performance has picked up with improving investor sentiment towards Asia.

Scottish Mortgage Trust PLC gives all-around exposure to a concentrated portfolio of global growth equities.

Process: The Baillie Gifford long-term global growth team apply a patient and disciplined approach to global equity investment. The process is benchmark-agnostic and the trust is likely to have material exposure to unlisted investments.

Performance: Returns have been exemplary, with the fund comfortably outperforming its average peer and index over the short, medium, and long term. Investors, however, can expect these returns to come with substantial volatility.