Noted investor Warren Buffett’s Berkshire Hathaway BRK.A BRK.B recently released a list of holdings for the fourth quarter of 2023. The report suggests that Buffett’s company did not buy many stocks last quarter, adding no new names and increasing its stake in only three companies.

Warren Buffett’s Berkshire Owns 2 ETFs: SPY and VOO

Regardless of what Berkshire buys or sells, one of the cheapest ways for an investor to diversify is with an exchange-traded fund. If you want to buy what Buffett has at Berkshire, he has two ETFs:

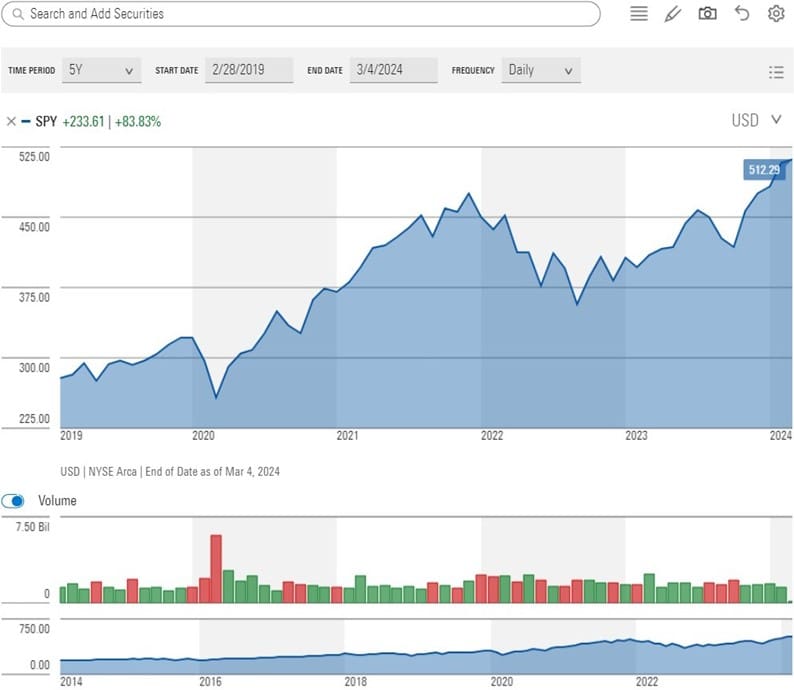

- SPDR S&P 500 ETF Trust (SPY)

- Vanguard S&P 500 ETF (VOO)

Both funds passively track the S&P 500.

Morningstar analyst Mo’ath Almahasneh, who covers both ETFs, says the bedrock of the strategy they follow is market-cap-weighting. “Market-cap-weighting harnesses the market’s collective wisdom of the relative value of each holding with the added of low turnover and associated trading costs,” Almahasneh says. “It’s a sensible approach because the market tends to do a good job pricing large-cap stocks.”

Mo’ath Almahasneh – Morningstar Analyst